latest

Covid-19: lessons from the Great Depression

This is the first of two articles looking at the potential impact of the Covid-19 crisis by looking at historical parallels and seeing what lessons can be learned from history. This article looks at the economic impact and what lessons can be drawn from historical UK recessions.

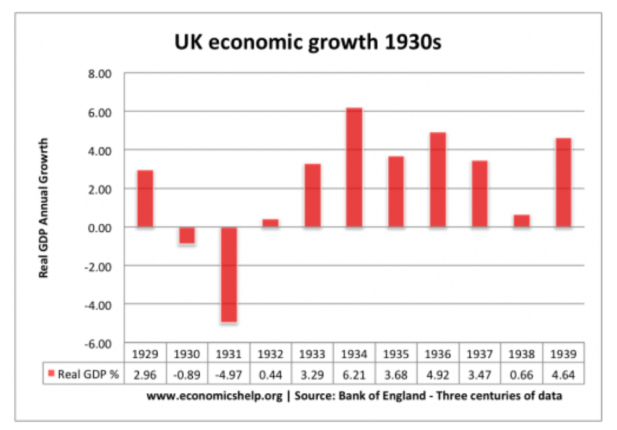

What is now beyond doubt is that the current Covid-19 crisis will trigger a recession as this is defined by two-quarters of negative growth. The latest Bank of England forecast shows that the UK economy will shrink by around 14% this year. To put this in context, the Housing crisis of 2008 only shrank the economy by around 2.5% but we have still not fully recovered from it. The scale of the forthcoming recession is liable to be much closer to (and perhaps larger than) the Great Depression of the 1930s which only saw the UK economy shrink by around 5%.

So if we are heading towards a recession that is potentially similar in scale to the Great Depression, what can we learn from how that impacted the economy, particularly in health and social care.

Length of the Great Depression

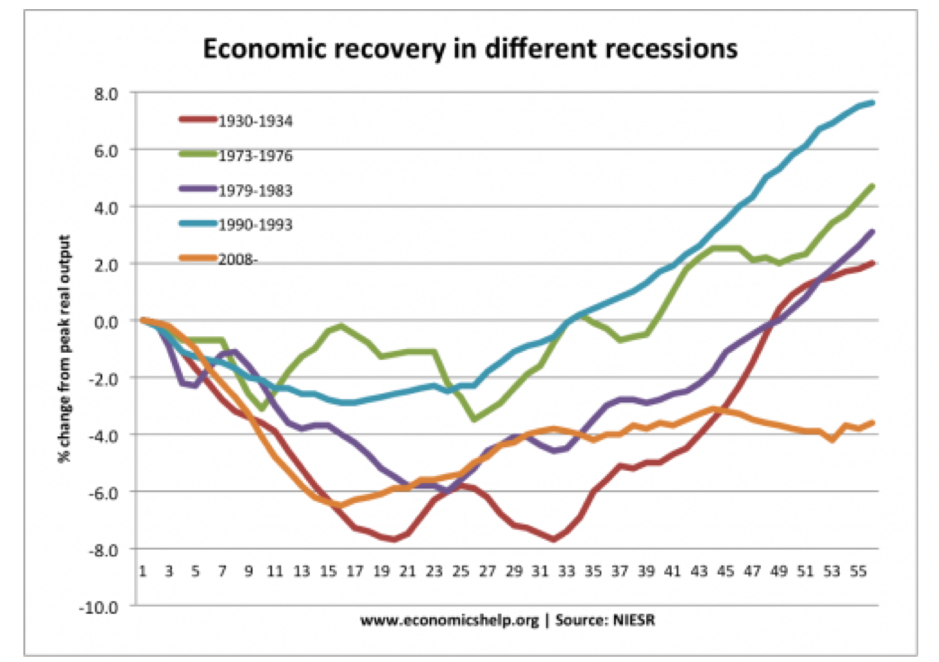

The Great Depression had 2 peaks (or troughs) approximately 20 months and 33 months after the start. Even the recession of the 2008 Housing Crisis peaked (or troughed) around 15 months after the start.

The UK economy did not recover to its original starting point in the Great Depression for 48 months and the economy has still not recovered to its starting point from the 2008 Housing Crisis even though that was 12 years ago.

Optimistic scenarios that suggest the UK economy will simply “bounce back” later in 2020 are simply not borne out by history. It seems much more likely that the upcoming recession will peak in late 2021 or possibly even late 2022.

Impact on unemployment

The impact on unemployment was significant in all recessions but the impact of the Great Depression was particularly significant. The peak unemployment rate for the whole UK was around 23% although this was not evenly distributed across the country. London and the South East had peak unemployment rates of around 13.5% but in the North of England, Scotland, Wales and Northern Ireland there were rates as high as 70%.

It is difficult to compare economies too much across the decades as so much has changed but the worst unemployment rates during my lifetime were in the 1980s under Margaret Thatcher’s Conservative Government where the national rates were around 13% and over 3 million adults were unemployed. The unemployment rate during the Great Depression was double that so it is not inconceivable that the upcoming recession might also generate average national rates of unemployment in the mid 20% range with perhaps 6 million adults being unemployed. The Office for Budgetary Responsibility has already increased its projection for the unemployment rate in 2020 to be as high as 10%.

Whilst much has changed, the relative economic position of London and the South East relative to the North of England, Scotland, wales and Northern Ireland hasn’t changed so again we would expect this to hit these areas disproportionately hard and to last disproportionately longer. One of the areas hardest hit was the town of Jarrow, where unemployment was the primary driver behind the famous Jarrow March, where unemployed workers marched 300 miles to London to protest.

Impact on the welfare state

Although the welfare state of the 1930s is not as comprehensive as it is today, there was a form of unemployment benefit designed to provide a basic safety net for the poorest and most vulnerable in society. Interestingly it was the perceived failure of the welfare state system in 1932 that led to the creation of a Royal Commission on Unemployment and the subsequent Unemployment Act of 1934.

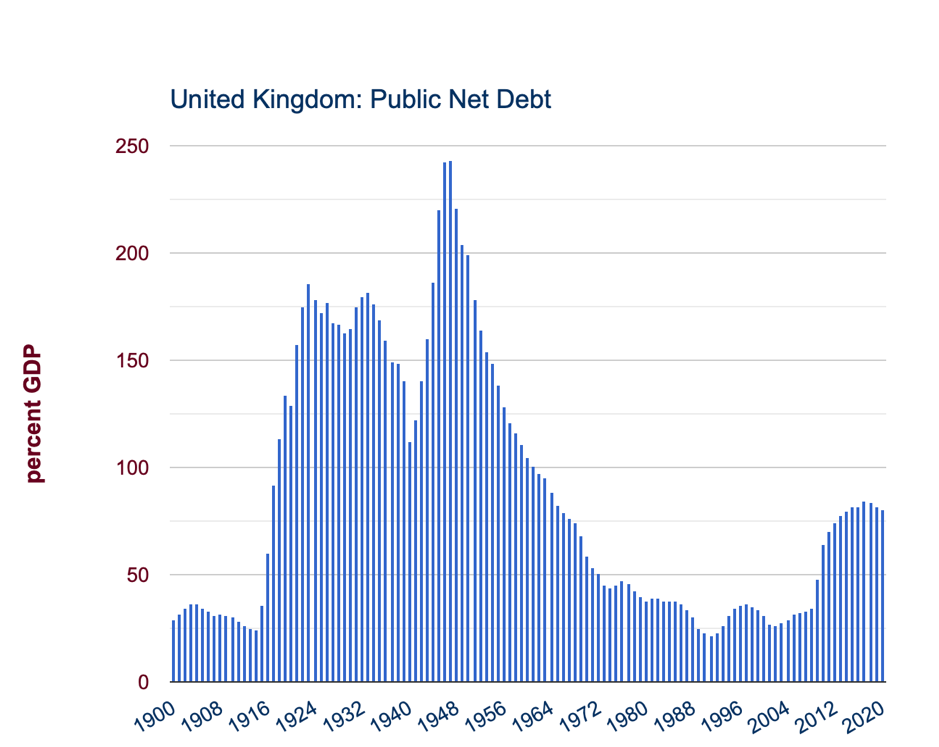

There was though huge political pressure to reduce expenditure on unemployment benefit as the level of state debt was around 180% of the UK’s Gross Domestic product (GDP). The latest projections from the Office for Budget Responsibility suggest that the projected level of borrowing could be £298bn which would be much higher than the peak of £150bn during the 2008 Housing Crisis.

If the level of Public Debt reached the sort of levels that the UK hit during the Great Recession then this would be more than double the impact of the Housing Crisis and the impact of that on the welfare state (the policies of “austerity”) can still be felt today more than 12 years on.

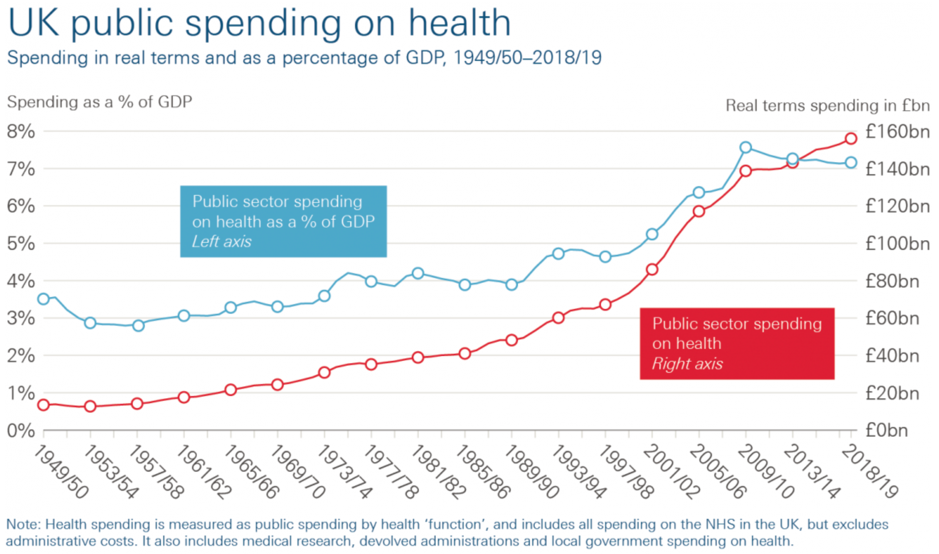

There is a very strong argument that the welfare state and particularly the NHS and social care have been underinvested in over the last decade and the Health Foundation’s analysis showed that UK spending on health as a percentage of GDP has fallen since 2008 and the beginning of austerity.

If the pressure on public spending is much greater than that experienced in 2008 then it seems likely that there will be simultaneous downward pressure on NHS and social care budgets at a time when demand may surge. We know that NHS England are predicting significant increases in demand and we still don’t know what the impact will be of the delayed treatments during the peak of the current crisis. It is worth recognizing that demand predictions are notoriously complicated though and although we know people haven’t been going to GPs, A&Es, hospitals for a few months, equally many elderly people are dying who may well have likely to have been significant users of services.

Whether the exact shape of the current recession ends up closer to the Great Depression or the Housing Crisis or some other pattern is hard to predict but the GDP reduction and the unemployment rates are both already predicted to be much greater than the Housing Crisis of 2008 and may be of the same scale as the Great Depression. Whilst the reaction to economic depressions is ultimately a political and economics choice, the context looks very likely to be a recession that will hit twice as hard as the 2008 Housing Crisis, last 2 to 3 years, generate levels of unemployment around twice that of the 1980s and be associated with a huge pressure on public sector spending.

In the second article, I will be looking at the lessons we may be able to draw from previous pandemics.